5 Blockchain Solutions to Improve Transparency in Carbon Trading

As efforts to mitigate climate change continue to progress, we can ask ourselves: how can we enhance these projects and initiatives to truly mitigate climate change? When it comes to mitigation efforts, carbon trading via carbon credit markets has made the most noise, but not without its own set of challenges and limitations. Carbon trading has faced challenges not only in its transparency, but also in areas such as accountability, access, and inclusion. These are the areas where blockchain technology can become a solution and support the ongoing maturity of carbon trading markets– let’s dive deeper.

The Problem

First, let’s discuss the ongoing issue of the lack of transparency in carbon trading and the broader carbon market. At its core, the market is overly reliant on third-party agents who are the bridge between the supply of carbon project developers and the demand of consumers.

Simply put, not only do third-party agents have too much negotiating power, but they are also the only connection between the carbon project developers and consumers, while receiving the majority of the benefits from the transactions between the two parties. Furthermore, third-party agents often are the owners and managers of private carbon databases; therefore, they can control who has secure access to the data. Because they are the brokers of the data, they also control who can participate in the carbon market–ultimately, creating a highly centralized network of databases that is neither transparent nor inclusive.

Lastly, in addition to centralized carbon markets with specific standards created by third-party agents, there is also a lack of global standards and regulations. This negatively impacts the ability of consumers to verify and compare the quality of carbon data. Combine that with the operation and administration costs and bureaucracy at all levels, and the lack of transparency becomes a serious limitation for carbon reduction.

Next, let’s discuss the potential blockchain solutions to drastically improve transparency in carbon credit trading.

Blockchain Solutions for Enhanced Transparency in Carbon Trading

Nations around the world are facing challenges and feeling the pressure of the carbon emission reduction goals set by the Paris Agreement. The concerns regarding the management of carbon trading and carbon markets are real. Blockchain technology is in a prime position to address the problems faced by carbon trading participants and the broader carbon market, specifically in areas such as, but not limited to, increasing transparency, decreasing costs, improving verifiability, and fostering trust.

The Solution: Understanding How Blockchain Works

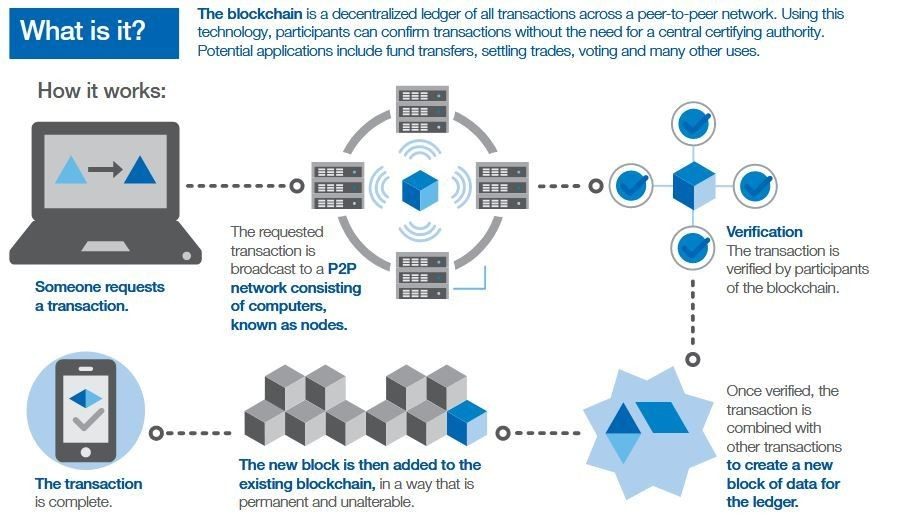

The key feature of blockchain’s transformative technology is its digital immutable ledger where transactions are recorded, in addition to its distributed network and cutting-edge cryptography features. Essentially, blockchain enables the trust to drive the transparency needed for carbon credit trading and carbon markets to take the next step and overcome their challenges. To learn more about the benefits of blockchain, check out this article.

Next, let’s dive further into the areas of limitation in which blockchain can improve transparency, efficiency, traceability, and trust for carbon market trading.

1. Double Counting of Carbon Emission Reductions

Double counting is a situation that occurs when two parties involved in the process of carbon emission reduction both claim the same carbon reduction. This is in contrast to a normal counting of emission reductions that clearly verifies the reduction of the carbon emission and a carbon credit is produced. Double counting usually occurs when there is miscommunication between two parties, such as a business trying to offset its carbon emissions and the country in which the business resides that wants to reach global climate targets.

Blockchain technology has the potential to mitigate this common occurrence in carbon market trading by improving the authenticity and reliability of these cross-party transactions. Ultimately, this will not only lead to improved trust, but also lower maintenance and power costs, which can only make the carbon market more attractive for investors.

2. Greenwashing in Carbon Trading

Greenwashing is a common environmental marketing tactic that occurs in the broader carbon market. It refers to when a business presents misleading information about its product/service to look like they are “green,” or environmentally friendly, when in reality, they are not. Because eco-friendliness is a worldwide market trend, the company may provide inaccurate or unreliable data to show their customers that they are also eco-friendly.

Blockchain technology can be implemented to enhance both the accuracy and reliability of carbon data. It can be successful by contributing to the decentralization of databases and improving the transparency of transactions, enabling customers to better audit the data or product across all levels using the blockchain’s immutable ledger.

3. Traceability of Carbon Market Trading

Voluntary carbon markets are currently limited in terms of scope and accessibility. As evident in the issue of double counting, carbon emission reductions are not easy to track and report; therefore, there needs to be improvements in the technological infrastructure to better support the monitoring of carbon trading data.

Utilizing its immutable ledger, blockchain can effectively and efficiently track the progress of a carbon offset from the point where it is generated, bought, and eventually discarded. Customers and stakeholders will be able to transparently view this data, improving the accessibility and auditability of the data. Furthermore, blockchain-powered cryptocurrencies also have the potential to empower individuals to start purchasing carbon credits if they want to be rewarded for reducing their carbon emissions–something that is still not prevalent due to organizational dominance of the markets.

4. Monopolization of Carbon Trading

As mentioned earlier in this article, the carbon trading market is overly reliant on third-party agents who hold too much influence and power in dictating the market and its participants. If not regulated, the carbon trading market could eventually become monopolized and controlled by a few players.

Blockchain technology can counter the monopolization of carbon credit trading because it effectively eliminates the need of third-party agents who currently act as a bridge between supplier and customer. Blockchain not only enables the streamlining for direct trading of carbon credits, but also saves the immense time and costs incurred from third-party approval. For example, smart contracts can digitize and automate the contract negotiation process for trading carbon credits, essentially replacing third-party agents. Lastly, enabling direct access to carbon data on the blockchain enables customers to objectively look at the pre-authenticated data and choose which organizations to support or do business with.

5. Financial Processes in Carbon Trading

The carbon market has created enormous amounts of money flowing in from carbon credit trading. However, finances are not always going to the appropriate areas in need. The financial processes in carbon trading need to improve to address the misplacement of organizational funds, so that funds are used to reduce carbon emissions and not pay for other political agendas. Moreover, the revenue generated from carbon markets need to be made accessible to all participants, and not only a few.

Currently, blockchain technology is already being used to enable crowdfunding campaigns to generate funds for projects and decentralized financial transactions to allow more market participants. Additionally, blockchain is allowing consumers to bypass third-party brokers like banks and other financial institutions. Therefore, blockchain can also be used to support financial transactions that contribute to carbon emission reduction and create new infrastructure to facilitate decentralized carbon markets. Ultimately, these financial transactions will be able to be authenticated on the blockchain, and become accurate and verifiable market data.

End Note

The current state of blockchain in regards to the carbon trading market is still nascent; however, blockchain use cases and solutions in carbon trading are developing rapidly. Blockchain’s potential in addressing the challenges of carbon trading, such as transparency, traceability, monopolization, greenwashing, and financial limitations like double counting, cannot be ignored. Governmental organizations, NGOs, and other businesses are all beginning to realize blockchain technology’s potential in efforts to reduce climate change around the world, particularly in areas like sustainable monitoring, reporting, and verification of carbon data, decentralized access to carbon data, and sustainable resource management.

To learn more about carbon offsetting and how blockchain can improve the broader carbon trading market, read this introductory article. Then, take a look at this article outlining how blockchain is the digital enabler for a more sustainable future.