Carbon market ITMOs: an overview

Carbon markets are in dire need of an overhaul and major improvements. The global climate change crisis is hovering over the world like a dark ominous cloud in an incoming storm. Ratified during the COP21 and initiated in 2020, the Paris Agreement has shown that nations need incentives to reduce carbon emissions in a productive way–and flourishing carbon markets are a potential solution. Article 6 in the Paris Agreement has given nations a novel and innovative standard–different from that outlined in the Kyoto Protocol–that has created a new unit of trade for the carbon credit market to comply with the Nationally Determined Contributions (NDCs) outlined in the agreement: internationally transferred mitigation outcomes (ITMOs). This article will introduce and give an overview of carbon market ITMOs, and see why they can be important in the global efforts against climate change. Let’s get started.

What are carbon market ITMOs?

As mentioned in the introduction, internationally transferred mitigation outcomes, or ITMOs, are a new unit of trade for the carbon credit market that was proposed in relation to Article 6 of the Paris Agreement. It is a new tool that enables participant nations to achieve the objectives outlined in their Nationally Determined Contributions (NDCs) for the Paris Agreement. Similar to other commodities, ITMOs are designed to be traded between participants who have already achieved their NDC objectives (over-compliance) and those who have not yet done so (under-compliance).

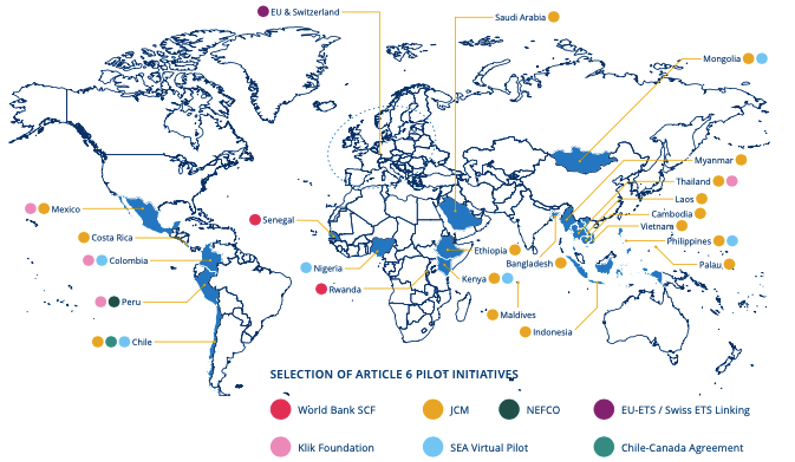

For further background on ITMOs, we can dive deeper into Article 6 of the Paris Agreement, which essentially establishes the groundwork for voluntary international cooperation among participant nations to achieve their NDC objectives ITMOs can be segregated into two mechanisms under the Paris Agreement: one for bilateral trading of mitigation outcomes under Article 6.2 and one global market mechanism for trading ITMOs under Article 6.4. Article 6.2 outlines that two nations can make an agreement in which Nation A can reduce carbon emission and transfer those reductions to Nation B, who will be held accountable for those reductions and count it towards their NDC objectives. Moreover, in this case, when an ITMO is issued and moved to the responsibility of another nation, there needs to also be a corresponding adjustment because this ensures that Nation A will not use the ITMOs for their own NDC objectives.

Why are carbon market ITMOs important?

In efforts to mitigate climate change, there is never enough space for new potentially ground-breaking solutions. Carbon market ITMOs have massive potential because they essentially help create new markets–both voluntary and compliance carbon markets–which can further incentivize nations around the world to reduce their carbon emissions. Furthermore, ITMOs also enable further international cooperation on climate policies between nations. For example, during the UN Climate Conference in Glasgow (COP26) last year, two nations Peru and Switzerland came to a bilateral agreement on implementing ITMOs between them. To reduce carbon emissions, Peru is committed to the improvement of cooking stoves in rural Peruvian communities. Ultimately, this commitment to the implementation of ITMOs not only increases the trust and accountability of carbon credit trading mechanisms, but also helps develop more collaborative carbon reduction projects and subsequently increases the demand for the carbon credit market.

Potential carbon markets created from the implementation of ITMOs

In accordance with the Paris Agreement, here are three types of markets that may help facilitate the trading of carbon market ITMOs between nation participants:

Options trading market

The options market proposes selling ITMOs via the method of “put options” as the participant reduces their carbon emissions from the excess of its objectives or via “call options” purchasing credits to achieve NDC compliance objectives. Essentially, the options market can be attractive to parties because it enables parties to increase their own benefit while reducing market uncertainty. However, similar to the next market we will discuss (spot markets), the options trading market can face issues regarding accountability of contractual obligations to trade ITMOs. Options may not even be offered to be available for trade.

Spot markets

Spot markets enable parties, who are unsure of the under or over-fulfillment of their NDC compliance objectives, to still trade ITMOs despite their NDC commitment period coming to an end. However, there are concerns regarding the potential low supply of ITMOs near the end of the NDC commitment period which may lead to worse issues such as liquidity problems. Therefore, nation participants are incentivized to meet only their Paris Agreement emission reduction targets, instead of trading ITMOs, which could make ITMOs irrelevant and unnecessary.

Forward derivative contracts for ITMOs trading

Forward contracts for the trading of ITMOs was an official UN standard from the Kyoto Protocol in 1997 that are being considered for a comeback. The goal of these contracts is to enable market certainty that future carbon reduction results will be sold at a predetermined price or a predetermined price formula. Therefore, forward contracts are especially attractive to lower income and less developed countries.

End Note

In conclusion, carbon market ITMOs have massive potential to incentivize carbon reduction efforts to battle climate change. However, there are still improvements that need to be made for ITMOs to be effective. For example, international donors and financial institutions can provide monetary support for international climate policy finance that can lead to more carbon market ITMOs transactions. Another method to increase the proliferation of ITMOs can be allowing banking transactions of ITMOs assets beyond the 2030 deadline set by the Paris Agreement. Lastly, if carbon market ITMOs trading were to become more efficient, this would reduce implementation costs for the Paris Agreement which could lead to loftier NDC objectives and an overall reduction of carbon emissions.

For further reading on potential solutions for the climate change crisis, take a look at our article on carbon clubs.